Introduction

In textile manufacturing, where margins are thin and supply chains are sensitive to market swings, the importance of financial discipline cannot be overstated. Businesses depend heavily on timely buyer payments and predictable procurement schedules. Any disruption can trigger cash flow issues that cascade into loan defaults. In this scenario, a textile SME defaulted on its working capital loan. But instead of initiating lengthy legal procedures, the lender opted for a more progressive path—activating PrivateCourt’s digital ADR process. PrivateCourt’s reputation for fairness, speed, and digital efficiency led to a solution that preserved the business relationship while securing a legally sound repayment plan.

In textile manufacturing, cash flow cycles are deeply tied to seasonal orders, vendor payments, and material procurement schedules. When any of these elements falter, loan defaults can follow quickly. This case spotlights how PrivateCourt enabled an effective instalment-based repayment plan between a digital lender and a textile SME borrower. What could have evolved into a legal standoff was transformed into a digitized, enforceable solution—thanks to PrivateCourt’s structured facilitation.

Dispute Snapshot

The respondent was the proprietor of a small but growing textile manufacturing business catering to domestic wholesalers. A working capital loan was availed to finance the procurement of raw materials for a bulk order. Initially, the business showed steady cash flows, and repayment obligations were being met. However, operational delays in dispatching orders led to postponed payments from buyers. This misalignment in the receivables cycle triggered stress on the working capital structure. With Rs. 95,555 outstanding and no formal renegotiation taking place, the lender sought timely intervention via PrivateCourt to resolve the impasse before it escalated.

The respondent, the proprietor of a textile unit, had taken a working capital loan to manage procurement for a large domestic order. While initial repayments were made on time, delays in order dispatches and payments from wholesale buyers began to strain the company’s cash reserves. With Rs. 95,555 in arrears and no clear roadmap from the borrower, the lender activated the ADR clause and approached PrivateCourt to mediate and streamline the resolution process.

The Journey to Default

By early 2025, it became apparent that the borrower’s cash inflow would not recover in time to honor the original EMI schedule. Continued delays in vendor payments and mounting production overheads strained liquidity. The borrower acknowledged the challenge but was unable to provide a repayment schedule independently. The lender, having previously experienced the efficacy of PrivateCourt, opted for digital mediation to chart a structured resolution. PrivateCourt’s outreach involved neutral communications, reminders, and engagement touchpoints that eventually led the borrower to participate actively. The presence of a third-party platform brought clarity and accountability, ultimately making way for a practical settlement.

The borrower’s business had relied heavily on a few bulk contracts, which unfortunately experienced supply chain lags. Despite continuous effort to stabilize finances, the repayments started slipping by early 2025. Recognizing the borrower’s cooperative intent, the lender preferred a non-litigation route and chose PrivateCourt as a neutral platform. Once engaged, PrivateCourt initiated structured outreach that encouraged the borrower to participate actively. The presence of an unbiased third party made negotiations more comfortable, ultimately resulting in a feasible repayment structure.

Timeline of Key Events

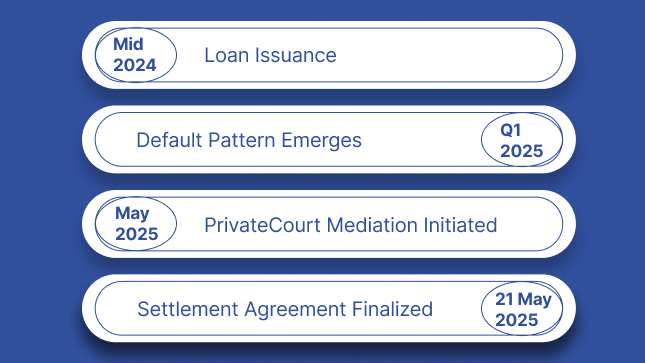

| Date | Event |

|---|---|

| Mid 2024 | Loan Issuance |

| Q1 2025 | Default Pattern Emerges |

| May 2025 | PrivateCourt Mediation Initiated |

| 21 May 2025 | Settlement Agreement Finalized |

Documentation and Submissions

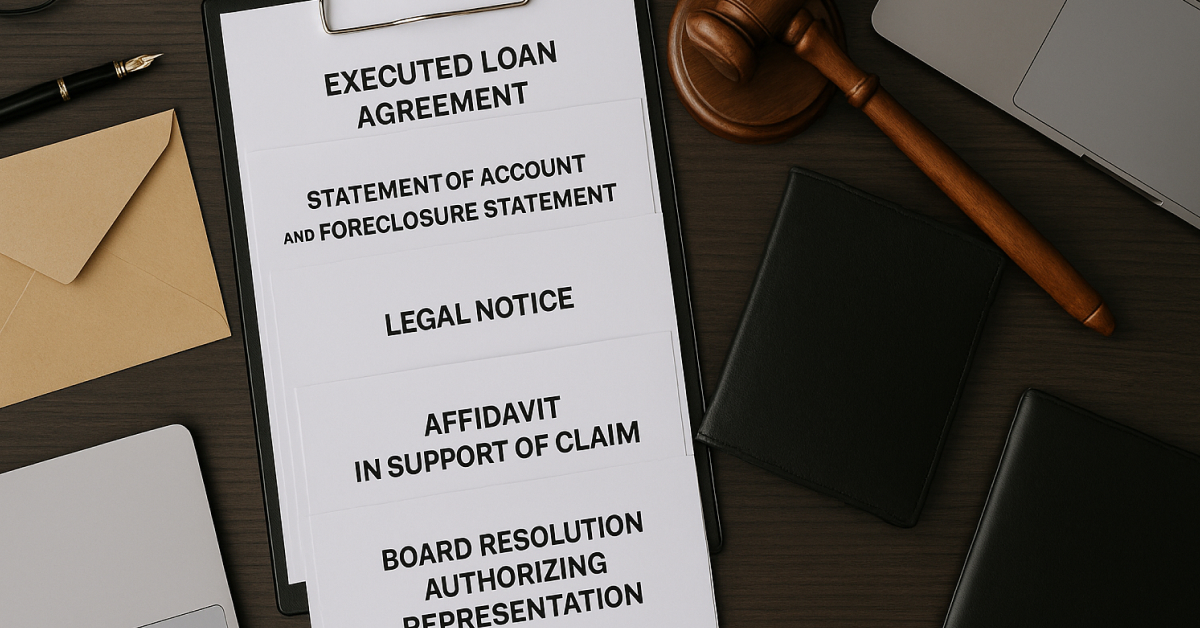

- Executed loan agreement and repayment breakdown

- Account ledger with default history

- System-issued reminder notices

- Statement of borrower’s financials

- ADR consent documentation

The ADR Process Facilitated by PrivateCourt

PrivateCourt’s process was built on clarity and timeliness. The mediation was conducted virtually, and both parties had the opportunity to share concerns and propose solutions. The borrower agreed to an upfront payment of Rs. 20,000 by 31 May 2025 and committed to closing the balance by 15 June 2025. The agreement was digitally recorded, timestamped, and backed with an 18% penalty clause in case of deviation.

Final Award (Dated: 21 May 2025)

- Settlement Amount: Rs. 95,555/-

- Payment Terms: Rs. 20,000 by 31 May 2025; balance by 15 June 2025

- Penalty Clause: Revival of entire claim with 18% annual interest if breached

Final Insights

This case reinforces how trust and timing, when managed by a credible ADR facilitator like PrivateCourt, can restore financial accountability without damaging relationships. The fully digital process ensured speed and documentation integrity. For the lender, it was a clean, legally sound closure. For the borrower, it was a second chance. For both—proof that dispute resolution doesn’t need to be disruptive.

keywords:Loan Default, PrivateCourt, ADR, Textile Loan, SME Resolution, Digital Mediation, Instalment Repayment