Introduction

Micro and small enterprises form the economic backbone of many regional markets. Yet, when faced with financial strain, their limited resources often lead to credit defaults. This case illustrates how PrivateCourt’s structured ADR process empowered both lender and borrower to move beyond a standoff. The result was a legally enforceable, single-instalment settlement that ensured timely recovery without reputational loss. By facilitating quick resolution through digital mediation, PrivateCourt once again proved how technology and neutrality can together restore financial clarity and business continuity.

Dispute Snapshot

The dispute centered around a loan taken by a small proprietorship involved in local supply and distribution services. The funds were used for operational expansion, including vendor acquisition and last-mile delivery upgrades. However, due to rising fuel costs, changing local demand patterns, and missed client payments, the business started experiencing losses. As a result, the loan, though modest at Rs. 30,000, remained unpaid beyond its due schedule. Traditional reminders failed to elicit action. Recognizing the need for timely closure, the lender invoked the ADR clause and transferred the matter to PrivateCourt for resolution.

The Journey to Default

What began as a growth-oriented initiative gradually turned into a liability as operational expenses outpaced revenues. The borrower’s attention was focused on salvaging cash flow and managing day-to-day business stress. Repayment obligations took a backseat, despite intentions to honor them. The lender initiated communication, which met with initial responsiveness but lacked commitment. Escalation through legal notice was considered, but the lender opted for a more efficient and less confrontational route by initiating ADR via PrivateCourt. This shifted the dynamic completely. With the intervention of a neutral third party, the borrower was able to assess the situation rationally and propose a structured one-time repayment plan.

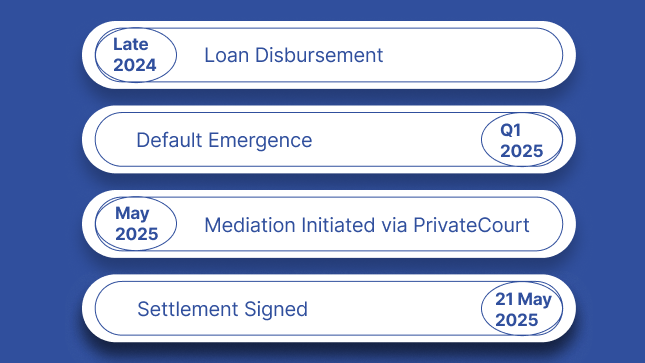

Timeline of Key Events

| Date | Event |

|---|---|

| Late 2024 | Loan Disbursement |

| Q1 2025 | Default Emergence |

| May 2025 | Mediation Initiated via PrivateCourt |

| 21 May 2025 | Settlement Signed |

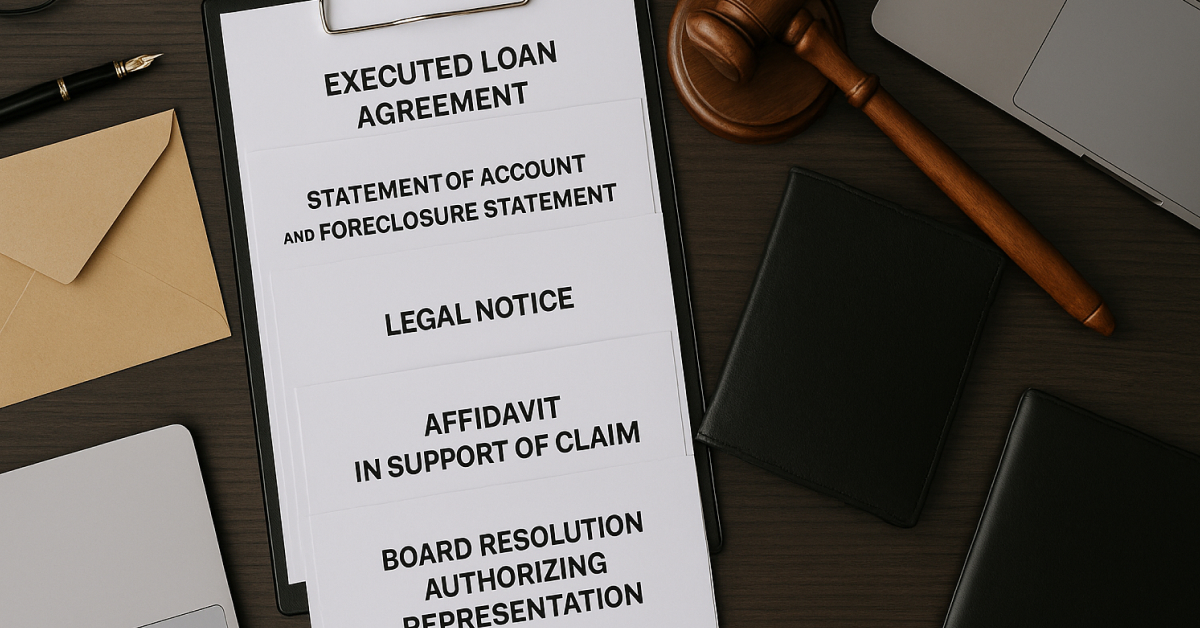

Documentation and Submissions

- Loan agreement and sanction letter

- Borrower account history and missed payment summary

- Default notifications and prior communication trail

- Consent to ADR mediation on PrivateCourt platform

- Settlement terms finalized and digitally acknowledged

The ADR Process Facilitated by PrivateCourt

PrivateCourt organized a fully online mediation session using its digital platform. The respondent participated via virtual conferencing, supported by representatives from the lender’s side. A calm, structured discussion was facilitated by the PrivateCourt mediator, during which the borrower proposed to clear the entire dues in a single payment of Rs. 30,000 by 31 May 2025. The lender agreed, provided legal enforceability was embedded into the process. All discussions were documented, the terms digitally signed, and an 18% interest clause included in case of non-payment.

Final Award (Dated: 21 May 2025)

- Settlement Amount: Rs. 30,000/-

- Repayment Term: One-time payment by 31 May 2025

- Enforcement Provision: Entire original claim revives with 18% interest upon breach

Final Insights

This case illustrates how PrivateCourt’s ADR framework can be a lifeline for both MSMEs and digital lenders. In a situation where recovery was uncertain and legal options costly, PrivateCourt’s timely digital mediation enabled a transparent, enforceable resolution. The platform’s neutrality encouraged cooperation, while its process integrity ensured that agreements were more than just verbal commitments. For the borrower, it was a chance to settle without losing business reputation. For the lender, it was a swift, risk-managed closure. For both parties, it reinforced that structured dialogue, when facilitated professionally, can resolve disputes even before they escalate.

keywords:Loan Default, PrivateCourt, MSME ADR, Digital Mediation, One-Time Settlement, Dispute Resolution, Small Business Recovery