Introduction

With the growing reach of digital lending, structured loan agreements have become commonplace, especially among micro and small enterprises. However, when repayment lapses and borrowers disengage, it becomes critical to resolve such defaults through neutral, legally sound avenues. In this case, a loan default amounting to Rs. 4,31,103 was addressed through PrivateCourt’s digital arbitration process. Despite the borrower’s absence, an ex-parte award ensured that the lender’s recovery rights remained intact, showcasing the value of enforceable ADR mechanisms.

Dispute Snapshot

The borrower had taken a business loan backed by an agreement containing a clear arbitration clause. The sanctioned amount, disbursed digitally, was scheduled to be repaid through structured EMIs. However, soon after initiation, the borrower failed to maintain repayment obligations. With no meaningful response to notices and reminders, the lender was left with no choice but to escalate the matter. The claim, supported by proper documentation, was submitted to PrivateCourt for arbitration under its neutral facilitation model.

The Journey to Default

The borrower in this case operated a small general retail business in a semi-urban area. While initial due diligence checks were successfully completed at the time of disbursal, it is likely that the enterprise faced early-stage operational or cash flow challenges. The nature of business—being dependent on walk-in customers and seasonal demand—may have led to revenue disruptions, ultimately impacting the ability to service the loan. As EMIs fell behind, the lender reached out with reminders and formal notices.

This default escalated into complete silence from the borrower’s side, even after receiving formal communication and legal notice. The claimant made timely efforts to engage, but the respondent's refusal to acknowledge or participate necessitated ADR escalation. PrivateCourt initiated proceedings by appointing an arbitrator and issuing notices. However, due to the respondent’s continuous absence, the matter was heard and concluded ex-parte—ensuring legal compliance and protection of the lender’s position. into complete silence from the borrower’s side, even after receiving formal communication and legal notice. The claimant made timely efforts to engage, but the respondent's refusal to acknowledge or participate necessitated ADR escalation. PrivateCourt initiated proceedings by appointing an arbitrator and issuing notices. However, due to the respondent’s continuous absence, the matter was heard and concluded ex-parte—ensuring legal compliance and protection of the lender’s position.

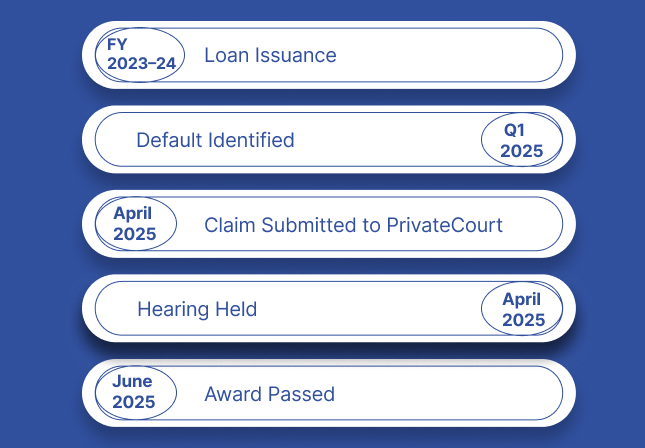

Timeline of Key Events

| Date | Event |

|---|---|

| FY 2023–24 | Loan Issuance |

| Q1 2025 | Default Identified |

| 02 April 2025 | Claim Submitted to PrivateCourt |

| 14 April 2025 | Hearing Held |

| 19 June 2025 | Award Issued |

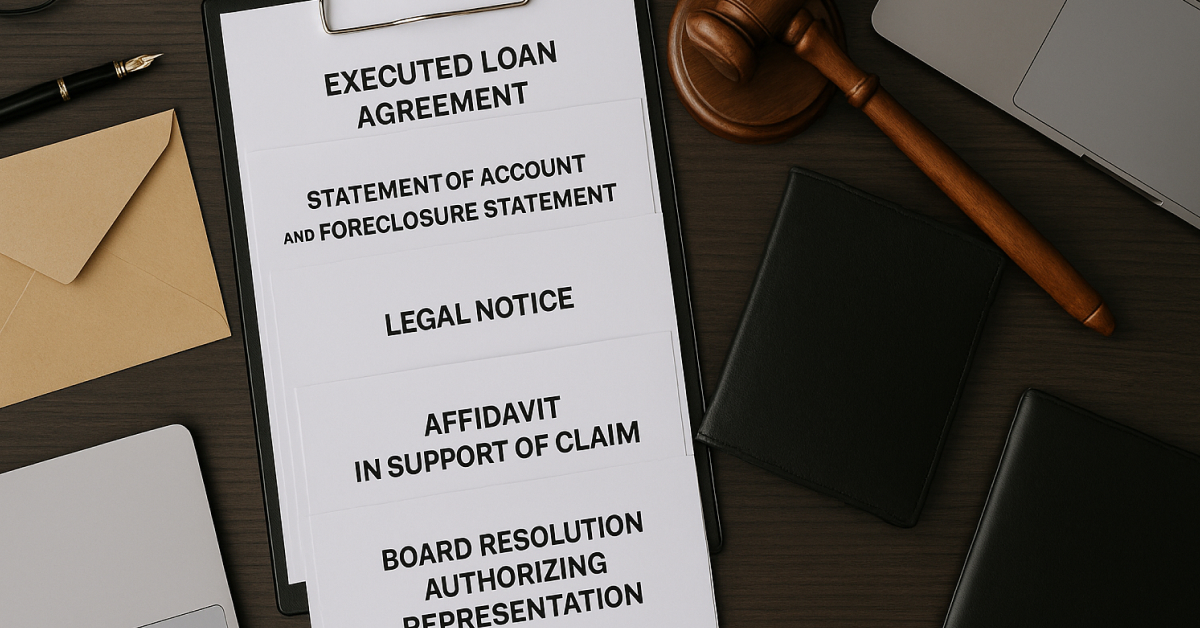

Documentation and Submissions

- Executed loan agreement with ADR clause

- Claim statement and notarized affidavit

- Default notices issued and delivery proof

- Borrower’s loan account and transaction summary

- Authorization for claimant representative

The ADR Process Facilitated by PrivateCourt

Upon registration of the dispute, PrivateCourt initiated the arbitration process in accordance with the Arbitration and Conciliation Act, 1996. The arbitrator reviewed all evidence presented by the claimant. Due efforts were made to reach the borrower via postal and digital channels. With no appearance or reply from the respondent, the arbitrator proceeded with an ex-parte hearing. All procedural steps were recorded and maintained by PrivateCourt, ensuring neutrality and transparency in the absence of the borrower.

Final Award (Dated: 19 June 2025)

- Outstanding Loan Amount: Rs. 4,31,103/-

- Interest Granted: @18% p.a. from 14/04/2025 till date of realization

- Arbitration Fee: Rs. 1,500 payable by respondent

- Award Status: Ex-Parte, legally enforceable

Final Insights

This case reinforces how PrivateCourt’s platform empowers lenders to pursue recovery legally and efficiently, even when borrowers are absent. The ex-parte award not only validated the claim but also preserved legal enforceability without lengthy litigation. PrivateCourt ensured neutrality, timely action, and full compliance with arbitration procedures—making it a vital support system in the digital lending ecosystem.

keywords: Loan Default, PrivateCourt, ADR, Arbitration, Ex-Parte Award, Digital Lending, Recovery Process