Introduction

When traditional recovery efforts yield limited results, a strategic shift toward neutral facilitation often provides the breakthrough needed. In this case, a digital lender found itself dealing with a stalled engineering loan nearing Rs. 1 lakh in dues. Rather than allow the dispute to escalate into a legal impasse, the lender opted for PrivateCourt's acclaimed ADR platform. This decision marked the turning point in the case. Known for its digital-first, unbiased, and highly responsive dispute resolution mechanisms, PrivateCourt facilitated a structured dialogue between parties.

The result was a prompt and dignified settlement process that reinforced the value of alternative dispute resolution in India's growing credit ecosystem. a strategic shift toward neutral facilitation often provides the breakthrough needed. In this case, a digital lender found itself dealing with a stalled engineering loan nearing Rs. 1 lakh in dues. Instead of opting for litigation, the lender turned to PrivateCourt's ADR platform—a move that led to a prompt and effective resolution. The structured intervention offered by PrivateCourt proved instrumental in salvaging a delicate business relationship while recovering dues in a legally compliant and mutually agreeable manner.

Dispute Snapshot

The borrower, a regional engineering firm operating under a sole proprietorship, had secured a loan intended to scale production capacity and invest in upgraded machinery. With expectations of strong returns and operational growth, the business initially showed promise. However, volatility in demand and procurement delays created a resource bottleneck, ultimately affecting cash flows.

As EMI defaults became consistent, the lender explored informal engagement tactics, all of which failed. Turning to PrivateCourt allowed the matter to be reframed constructively, with scope for mutual understanding and compliance. operating under a sole proprietorship, had secured a loan intended to scale production capacity and invest in upgraded machinery.

Initially, the repayments were timely, reflecting optimism in business growth. However, market unpredictability—exacerbated by project delays and low liquidity—led to successive EMI defaults. Despite multiple soft recovery attempts, the situation stagnated until the ADR clause was invoked.

The Journey to Default

Over the first two quarters post-disbursal, the borrower showcased promising signs of expansion. Orders increased, and additional workforce was onboarded. However, a critical machinery procurement got delayed due to supplier issues, resulting in cascading delays in project execution.

The disrupted timelines led to weakened cash flow, which directly impacted the ability to service the loan. Despite regular follow-ups and structured reminders by the lender, the borrower grew increasingly unresponsive. It was only after the intervention by PrivateCourt, acting as a neutral facilitator, that a meaningful dialogue was reestablished—reviving the path to financial compliance. the borrower showcased promising signs of expansion. Orders increased, and additional workforce was onboarded.

However, a critical machinery procurement got delayed, and cascading delays in project execution began to hurt incoming cash flows. As finances tightened, loan servicing began slipping.

With trust eroding and communication gaps widening, the lender issued repeated notices before opting for ADR facilitation through PrivateCourt. The choice to engage a neutral facilitator helped reinitiate dialogue in a controlled environment, proving vital to the eventual resolution.

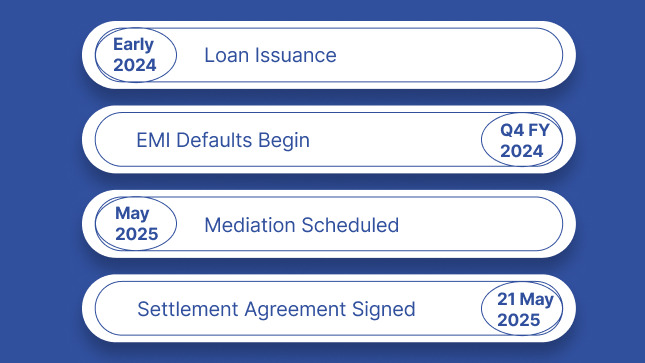

Timeline of Key Events

| Date | Event |

|---|---|

| Early 2024 (estimated) | Loan Issuance |

| Q4 FY 2024 | EMI Defaults Begin |

| May 2025 | Mediation Scheduled |

| 21 May 2025 | Settlement Agreement Signed |

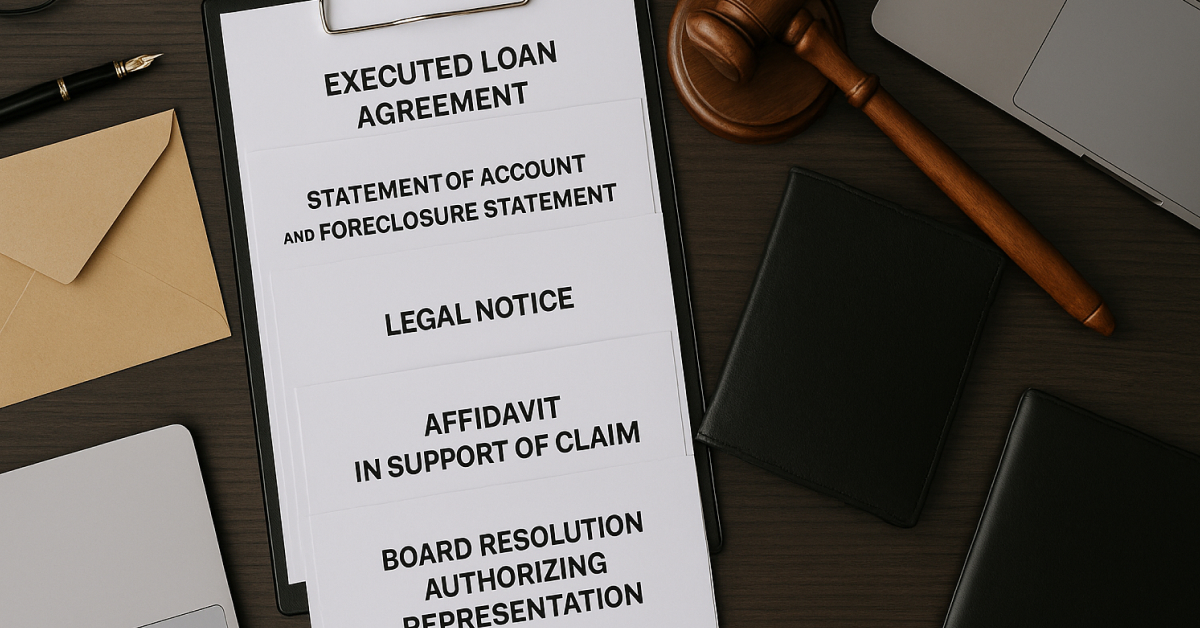

Documentation and Submissions

The claimant submitted:

- Executed digital loan agreement

- Loan account and transaction summary

- Default notices and response history

- Internal approval note for ADR invocation

- Digital acceptance of PrivateCourt’s process terms

The ADR Process Facilitated by PrivateCourt

PrivateCourt arranged a virtual mediation session using Zoom and telephone conferencing tools. Although both principal parties did not appear in person, their respective representatives entered into constructive discussions. Leveraging PrivateCourt’s digital platform and neutral facilitation, the parties quickly arrived at a settlement framework.

Under this agreement, the respondent consented to repay Rs. 98,292/- in two scheduled instalments—50% by 26 May 2025 and the balance by 15 June 2025. A structured fallback provision was included to convert the matter into e-arbitration at an 18% interest rate if terms were breached.

Final Award (Dated: 21 May 2025)

The settlement agreement was digitally signed and archived by PrivateCourt’s records system, concluding the ADR process:

- Settlement Amount: Rs. 98,292/-

- Repayment Mode: Two Instalments (26 May & 15 June 2025)

- Fallback Clause: Full amount payable with 18% interest in case of breach

Final Insights

This case is a textbook example of how strategic use of technology-backed ADR platforms like PrivateCourt can unlock stalled negotiations. With minimal friction and complete digital oversight, both parties avoided the delay and costs associated with court litigation.

The platform's neutrality, legal enforceability, and structured timelines enabled a resolution that was both prompt and future-facing. PrivateCourt’s intervention didn't just settle a loan—it reignited communication, preserved dignity, and kept commercial doors open.

keywords: Loan Default, PrivateCourt, ADR, Mediation, Digital Settlement, Online Dispute Resolution, Engineering Loan